By: Ana Gonzalez Ribeiro, MBA, AFC®

Accredited Financial Counselor®

For many people budgeting is difficult because many associate the word budgeting with a lack of or a tightening of the wallet. We don’t like to feel restricted. Having to focus on what we spend is not easy nor desirable. Perhaps we are so busy, its’ difficult to add another “to do” to our long list of things to get done or the process of creating a budget can feel intimidating and changing our habits is difficult.

According to, “The Secret Language of Money” by David Krueger, M.D., money is associated with a variety of emotions. For example, money can mean captivity for some. These folks avoid money for fear it will trap them and enslave them. Meanwhile, for others it could mean financial security which provides peace of mind and the ability to reach a measurable and attainable goal.

One way to change our perception is to view the process of creating a budget instead as a process of creating our financial goals and dreams. What do we want to do with the money we earn, what do we not want to do with it? Save for a vacation? Check! Buy a car? Check! Give more to charity? Check! Waste money on tchotchkes and on clothes to fill our already bulging closets? No thanks! Not have enough to live on when we retire? Nope!

Instead of creating our budget, we are creating our dreams, our new lifestyle.

Here is one way you can start creating your financial dreams.

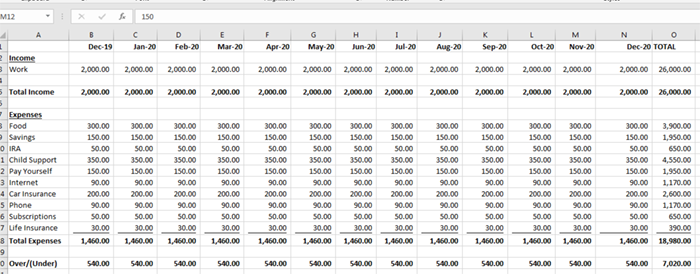

Set up a budget or financial goals sheet by reviewing where all your monthly expenses are going. On an excel spreadsheet, or piece of paper, make a list of all the items you spend on monthly. For example, list your rental or mortgage costs, childcare costs such as babysitting, child support, alimony, clothes, movies, dining out, transportation, utilities, home costs such as curtains, bedspreads, furniture, TVs, kitchen gadgets, etc. Jot down everything you spend money on and by that I mean everything.

Don’t leave anything out; otherwise you won’t see the complete picture.

Sample Excel File Budget

On the column next to this one write down your total income, subtract the expenses from your total income. What’s the difference? Do you have any money left or are you in a deficit? If you have some money left, great! Make sure some of this money is going towards saving for your emergency fund, retirement and college savings if you have kids. On the other hand, if you are just scraping by, you need to whittle down your expenses. What can you modify or stop spending on? Are you focusing on your essentials?

The great thing about writing down everything you make and what you spend on like this is that you can see it. You become more mindful of your money. Seeing where your money actually goes every month makes you more receptive to your spending habits and much more aware of where your hard earned money is going. This is a good thing! You are being proactive and taking control of your money, NOT the other way around. You are strong now and financially vigilant!

Creating a financial goal sheet will help you cut down on unnecessary spending habits and help you save more. Of course, you can’t be a scrooge either. Spend a little here and there on things that make you happy; promote your health and overall well-being but do it all moderately while also saving for a rainy day.

Go ahead and try it! Be good to yourself.